Using In-Kind Donations for Program Expansion and Impact

Whether they’re collecting online contributions through a donation page, running a text-to-give campaign, or sending direct mail appeals, many nonprofits focus their fundraising efforts on monetary donations. While it’s always important to drive more funds to your cause, diversifying your revenue allows you to maximize the contributions you receive and maintain your organization’s financial stability.

One revenue source you should incorporate into your strategy and prioritize is in-kind donations. According to Double the Donation’s fundraising statistics, 81% of donors already give food or other goods to nonprofits in the form of in-kind donations. These gifts can supplement monetary donations and help you make an even larger impact.

In this guide, we’ll answer all your burning questions about in-kind donations so you can make the most of this giving avenue. Let’s get started!

What are in-kind donations?

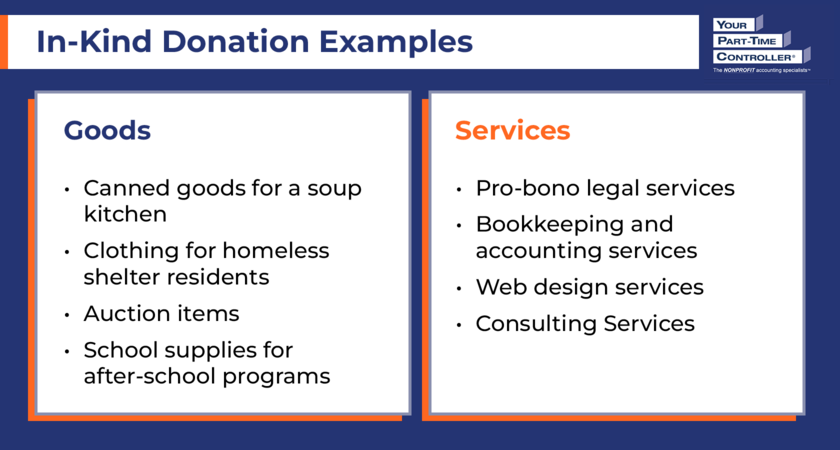

In-kind donations represent nonmonetary gifts. The two main types of in-kind donations are goods and services. While goods are materials or assets that your nonprofit can use, services are contributions of time or expertise.

To help you understand what falls under each category, YPTC’s in-kind donation guide provides the following examples:

Goods: canned goods for a soup kitchen, clothing for homeless shelter residents, auction items, and school supplies for after-school programs

Services: pro-bono legal services, bookkeeping and accounting services, web design services, and consulting services

There are additional types of in-kind donations that don’t fall neatly into either category as well. These may include gifts of land or buildings, use of facilities or utilities, advertising time, or works of art.

What are the benefits of in-kind donations?

Whether you’re hosting an event, promoting your organization, or just running your typical programming, in-kind donations can help you boost your impact without expending more costs or requiring donors to reach back into their wallets. When you leverage in-kind donations, your organization can:

Increase its financial flexibility. Your nonprofit likely needs many resources to support its programs and maintain smooth operations. Instead of sourcing and paying for these resources on your own, in-kind donations allow you to free up the funds you’d normally spend on these items or services and reallocate them to other areas of your budget. Additionally, if you receive items your organization doesn’t need, you can sell them for cash to generate more revenue.

Efficiently gather resources. When you collect in-kind donations, you can access the items you need immediately, as opposed to ordering them and waiting for them to arrive. Since you’re not purchasing these resources, you don’t have to get leadership approval, allowing you to put these items to use as soon as possible.

Form lasting relationships with local businesses. Many businesses prefer to give in-kind donations because they can contribute items they already have on hand or lend their expertise. By actively promoting and accepting in-kind donations, you can attract like-minded businesses that may be willing to become official sponsors of your organization and help you expand your impact.

In addition to offering benefits for your organization, in-kind donations allow donors to unlock more giving opportunities, better understand their contributions' specific impact, and contribute to environmental sustainability. Emphasize these benefits when promoting in-kind donations via your newsletter, website, or social media to encourage donors to get involved.

How can nonprofits collect in-kind donations?

Before you start collecting in-kind donations, you must create a gift acceptance policy. This document will outline the items your organization can and can’t accept and the conditions under which you’ll accept a gift. For example, a soup kitchen’s gift acceptance policy may indicate that they accept canned and nonperishable goods, but they must not be expired.

Outlining this type of policy provides guidance to potential donors and allows you to politely decline gifts you can’t accept. Ensure this policy is easily accessible for donors by featuring it in a highly visible place on your website.

Once you’ve developed your gift acceptance policy, use a combination of the following strategies to encourage and gather in-kind donations:

Develop an in-kind donation page. In addition to your standard donation page, create an in-kind donation page on your website. Here, you can feature your gift acceptance policy, frequently update your list of needed items, and let donors know how and where to drop off their contributions. Make sure this page follows web accessibility best practices like including alternative text for images and ensuring sufficient color contrast between visual elements so anyone can easily navigate the page.

Reach out to potential in-kind donors. Think about your major donors and biggest supporters to identify opportunities to secure in-kind donations. For instance, you may know that one of your donors is a web designer who may be willing to donate their time to sprucing up your website. Reach out to them with a personalized note that kindly gauges their interest in contributing so you can get the conversation going.

Create a wish list. Individuals often use sites like Amazon to create virtual wish lists, and your nonprofit can do the same. By telling donors exactly what you need, you’ll receive more useful in-kind donations and avoid turning donors away.

Call upon corporate sponsors. If you already work with a corporate sponsor, ask them whether they’d be willing to contribute to an upcoming project or initiative. Encourage them to help you out by highlighting the benefits for their business, such as a positive reputation among employees and consumers alike.

Host an event. When you host an event dedicated to collecting in-kind donations, you can bring your community together and create an exciting opportunity to support your cause. Consider upgrading your typical food or clothing drive by offering refreshments or raffles to boost participation.

Simplify the drop-off process. Make it as easy as possible for donors to drop off their contributions to maximize the chances they follow through. For example, you may provide multiple donation sites or even have volunteers pick up larger items from your donors for added convenience.

After you’ve collected in-kind gifts, you must report them within your nonprofit financial statements. This process involves determining each item’s fair market value (FMV), recording contributions, providing written acknowledgments to each donor, and reporting in-kind donations on your Form 990. If you need assistance with in-kind donation reporting, consider working with a nonprofit accountant.

Don’t neglect in-kind donations as part of your broader fundraising strategy. These contributions have the power to increase your impact and help even more beneficiaries using resources donors likely already possess. Make sure to thoroughly promote this giving option to donors so they’re well aware of this opportunity.